Berkshire Hathaway: or How I Learned to Stop Worrying and Look Beyond Warren Buffett

Kirsten Halpin

MBA 617

Final Project: Individual Case

I. Company Background and Description

Legendary investor Warren Buffett was first introduced to the company Berkshire Hathaway in 1962. He began purchasing shares in the company after noticing a trading pattern for the stock. However, Berkshire Hathaway was in the textile manufacturing business, an industry that had been steadily declining over the past several decades. In 1964, the company was facing severe financial troubles when the CEO approached Buffett regarding selling his shares back to the company. Buffett initially agreed to divest his position in the firm, but this decision was reversed when the written offer was listed as 12 cents per share less than the verbal arrangement already had determined. As an act of rebuttal, Buffett increased his position in Berkshire Hathaway and took control of it as the majority shareholder. After firing the CEO for being rudely cheap, Buffett realized that he was now in possession of a failing textile manufacturer. Naturally, he decided to shift the company’s strategic intent and transform it into what is now the third largest corporation in the United States when measured by market capitalization (Bloomberg, 2015).

Berkshire Hathaway has continued to evolve over the decades, and is now classified as a conglomerate holdings company. Over 300,000 employees located around the globe contributed to generating nearly $200 billion in revenue in 2014, ranking Berkshire Hathaway fourth on the Fortune 500 list (Berkshire, 2014b). There are two distinct investment methods that are used to create revenue for the organization: capital market investments and direct subsidiaries (Buffett, 1996). The company’s most significant capital market investments are accomplished through ownership of publically traded shares. According to the latest 13-F filing, Berkshire’s portfolio contains over fifty separate holdings, although over 80% of the investment in capital markets is concentrated in the 10 largest holdings (Berkshire Hathaway, 2014a).

The second source of revenue for Berkshire Hathaway is derived from wholly owned subsidiary companies. This has become increasingly important to Berkshire’s operations. The company currently has 54 independent subsidiaries, which operate in a variety of different industries. Over half of the current subsidiaries have been purchased since 2000, demonstrating Buffett’s increasing reliance on this tactic to increase Berkshire’s value. The increase in subsidiaries has benefited Berkshire because revenues are more protected due to the broad range of subsidiaries. This diversification of Berkshire’s revenue sources stabilizes the company’s future cash flows by providing insulation from business cycle shifts.

Much of the company’s operational success can be attributed to the fact that management has been able to identify and capitalize on the company’s core competencies to gain and sustain a competitive advantage. The first core competency is the management team itself. Warren Buffett’s expertise is largely credited with the organization’s current success. Often referred to as the “Oracle of Omaha”, Buffett is widely regarded as one the most successful investors of the current era. Berkshire Hathaway’s book value per share has increased as an average compounding rate of almost 20 percent per year for the past 20 years (Berkshire, 2015a). This rate of return is double that of the Standard and Poor’s 500 Index, which recorded approximately 9 percent compounding annual gains of over the same period of time.

Berkshire Hathaway’s second core competency is the method that the company utilizes to fund its investments. Berkshire Hathaway distinguishes itself from competitors by using cash and cash equivalents from its subsidiaries as the primary source of capital for new investment opportunities. The most significant source of cash is provided by the numerous insurance and reinsurance subsidiaries. Berkshire Hathaway has access to the “float”, which are funds received from premiums that are not required to be held for payment of claims. This provides Berkshire Hathaway with an interest free source of capital and allows the company to grow without increasing leverage and altering its desired capital structure. Also, with nearly $146 billion in funds available at the last reporting, Berkshire Hathaway has the ability to react swiftly to market changes that present above average investment opportunities (Buffett, 1996).

II. Berkshire Hathaway’s Organizational Structure

In spite of being a household name, Berkshire Hathaway remains somewhat of a corporate enigma. Information regarding Berkshire Hathaway’s organizational structure and culture is all but limited to public company filings. The company website left much to be desired. It was a simple web page consisting of thirteen separate hyperlinks that directed the user to either a simple text document or an external website. Please see Figure 1 in the Appendix for an image of the Berkshire Hathaway website homepage. The company does provide a regularly updated “Owner’s Manual” for shareholders, but the information contained in this document focuses on the company’s broad economic principles of operation and does not discuss the organizational structure of the company.

I contacted Berkshire Corporate to gather additional information. As no phone number was provided, I emailed the corporate address to request further information and a contact within the company that I could reach out to. A representative responded to inform me that all public information was disclosed on the website and it was company policy not to take additional questions, which are considered surveys (Hawk, 2015). However, I was able to compile information from public filings and other documents to piece together a rough outline of the organization’s structure.

Berkshire Hathaway lacks some of the traditional elements that are used to define an organization’s purpose. For example, the company does not directly list a mission statement, or any organizational goals or values. Buffett mentions in the “Owner’s Manual” that the goal of the organization is, “to maximize Berkshire’s average annual rate of gain in intrinsic business value on a per-share basis”, but this information is buried in the text of the document and not listed elsewhere on the company website (1996).

In spite of the lack of tangible documentation, Berkshire Hathaway has a very strong corporate culture. Many of the company values are derived from the personal beliefs and business principles of Warren Buffett. Transcripts from company meetings and interviews with executives reveal that Berkshire Hathaway has a very disciplined culture of trust, calculated risk taking, and an intrinsic value-based approach to how it does business. This culture is one of the reasons that it is able to operate in such a decentralized manner.

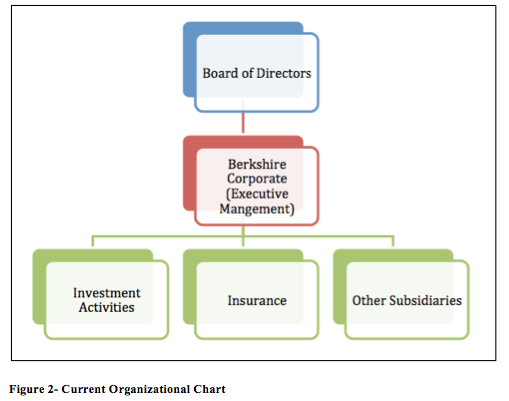

Berkshire Hathaway currently has a decentralized divisional organizational structure. The top layer of management is the Board of Directors, which is chaired by Warren Buffett. The second layer of management is found at Berkshire Corporate. Located in Omaha, Nebraska, Berkshire’s headquarters is comprised of only 25 employees, including the executive management team. The executive team at Berkshire Corporate is responsible for investment and capital allocation decisions, as well as selecting the CEO of each subsidiary (Berkshire, 2014b). The third layer of management is found in the subsidiaries themselves. Each company is operated completely independent from the others. Berkshire Hathaway’s latest Form 10-K states that, “there are essentially no centralized or integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal involvement by Berkshire’s corporate headquarters in the day-to-day business activities of the operating businesses” (Berkshire Hathaway, 2014b). The individual subsidiaries each have unique organizational structures and internal processes. Please see Figure 2 in the Appendix for Berkshire Hathaway’s current Organizational Chart.

III. Critical Evaluation

Berkshire Hathaway is an interesting company to evaluate as many of the factors that have led to its success could also be considered weaknesses. The company has been undergoing structural changes over the last decade and is facing significant management changes in the near future. Discussed below are several issues that have the potential to disrupt Berkshire Hathaway’s operations if not properly addressed.

The first potential problem is an overreliance on current top executives. Warren Buffett has been critical to Berkshire Hathaway’s success. One of the reasons that Buffett has been such an effective leader is that he has linked his personal success to Berkshire Hathaway’s success. He and his family personally own approximately one third of the outstanding Berkshire Class A shares, as well as one tenth of the outstanding Berkshire Class B shares (Berkshire, 2015b). This has allowed him to develop a corporate value of trust that has heavily contributed to the decentralized nature of the company. Buffett has championed the belief that the correct management team should be given the leeway to make independent decisions. He has also demonstrated that he is confident in the outcome of these decisions by his personal investment in Berkshire Hathaway.

Buffett’s exceptional leadership will be difficult, if not impossible, to replace. He is also 84 years old, which is young considering the Vice President is 90. Although the company states that it has a succession plan in place for both executives, the transition to a new management team will be difficult. Buffett’s values have shaped the organization’s culture, but these beliefs might not be strong enough to be carried on after he retires. Berkshire Hathaway needs to establish a culture and values that truly belong to the company and are independent of Buffett’s influence.

The decentralized nature of the company is the second factor that should be evaluated. Berkshire Hathaway is admittedly “unusually decentralized”, which has been a successful approach for the company in the past. However, the shift in strategy over the last decade has caused the company to focus on income from subsidiaries, which has in turn changed the structure of the company. Berkshire Hathaway has doubled its subsidiaries since 2000, many of these additions having similar operations. Allowing these companies to operate completely independent from one another neglect the economies of size and economies of scope that Berkshire Hathaway could develop and use to its advantage.

The primary concern that arises from the lack of centralization within the company’s subsidiaries is that this approach neglects to account for the natural synergies between the subsidiaries. For example, Berkshire Hathaway owns three separate companies in the jewelry industry. It is very possible that these companies could combine aspects of their individual businesses in a manner that would be mutually beneficial. One way would be to integrate supply chains to empower all similar companies when negotiating both upstream and downstream relations. However, these companies currently operate independently and do not benefit from any collaborative networks that already exist within Berkshire Hathaway.

IV. Recommendations

The following recommendations are proposed to address the previously mentioned issues. Berkshire Hathaway has excellent positioning when considering its external environment, so these changes are focused on strengthening the company’s internal environment.

1) Berkshire Hathaway should develop a stronger company culture. The goal of this venture would be to separate “Berkshire culture and values” from “Buffett culture and values”. I recommend creating a task force that would design a company wide program that could be implemented in all subsidiaries to give the individual companies a greater sense of collectivity and corporate unity.

First and foremost, the team should establish a company mission statement and a list of corporate values. Although the newly established policies might mirror the unstated mission statement and values that the company currently has, having official documentation has several benefits. Academic literature has long noted the positive impact that a well-defined mission can have on a company. Pierce and David state in their often-cited publication on the topic that firms with comprehensive mission statements tend to outperform their peers (1987). A mission statement is also used to guide the strategic planning process, which will be crucial for Berkshire Hathaway as it transitions into a new management team. The second benefit is that it will help to guide decisions for all levels of employees. Employees of the subsidiaries should be working for the advancement of Berkshire Hathaway as a whole, not just the success of the individual subsidiaries.

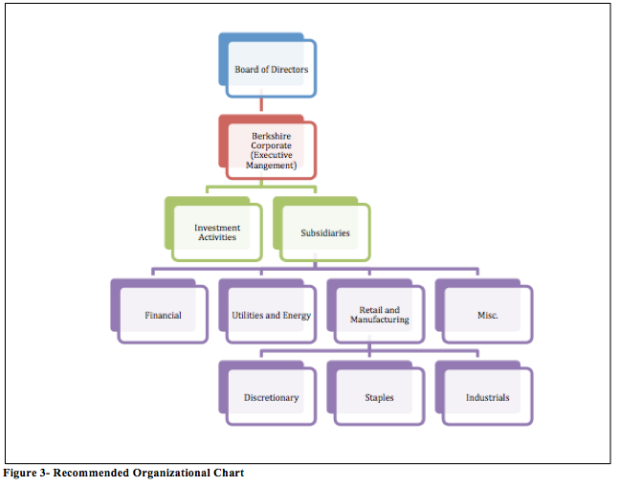

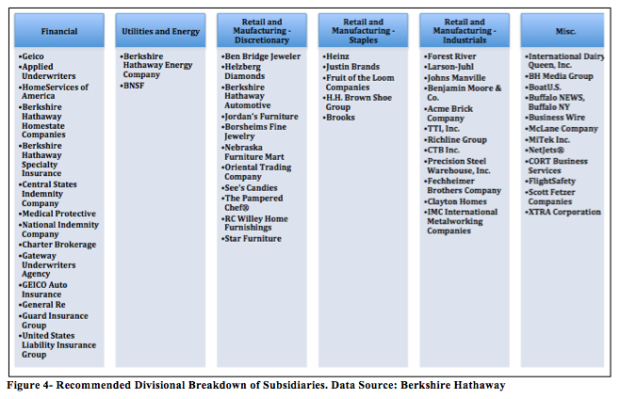

2) Berkshire Hathaway should consider revising its organizational structure to create an additional vertical linkage between subsidiary companies and Berkshire Corporate. This would be accomplished by adding a layer of divisional grouping between Berkshire Corporate and the individual subsidiaries. Subsidiaries would be classified by sector and industry. A management team could be assigned to each new division to coordinate the operations of the underlying subsidiaries. The goal of this change is to add a level of communication between the individual subsidiaries and the parent company, not to add an additional layer of management for decision-making. Please reference the Appendix for Figure 3, the proposed organizational chart, and Figure 4, a recommendation of what subsidiaries each division would contain.

There is a significant challenge to implementing this change. Adding vertical layers of structure can increase bureaucracy, which in turn could reduce the organization’s adaptability to changes in the external environment. This new level of management could also create resentment within the existing management teams of subsidiaries, as they are accustomed to working independently. However, with sufficient communication and planning, these changes should be able to be implemented without much difficulty.

3) Berkshire Hathaway should also foster horizontal linkages between subsidiaries operating within the same economic climates. I recommend that full-time integrator positions should be developed. These integrators would be positioned within the new divisional layers to coordinate between the specific division’s subsidiaries. These individuals would be responsible for examining the current operations to exploit any existing synergies between subsidiaries. To aid in the successful implementation of this strategy, the company should consider adopting a company wide enterprise resource planning system that would enhance the transfer of information between subsidiaries.

Horizontal linkages could be utilized in several ways to increase the company’s overall productivity. Economies of scale could be developed if processes between firms could be combined in a manner that reduces fixed costs. For example, combining the manufacturing for two separate shoe companies could benefit both companies. Economies of scope could also be established due to the wide variety of the subsidiaries. To accomplish this, management should evaluate the inputs and outputs of each subsidiary to see if there are any natural partnerships. For example, Berkshire Hathaway owns a supply chain management solutions company that could be used to provide services for the manufacturing companies. This would increase the number of clients for the one company, while increasing the efficiency of the others. Increasing horizontal linkages between subsidiaries would decrease the company’s dependence on external resources, creating an additional competitive advantage for Berkshire Hathaway.

V. Conclusion

Berkshire Hathaway is an excellent example of a company that has continued to grow and adapt in a rapidly changing environment. The leadership of Warren Buffett has propelled the company to create significant accounting and economic profits. However, an overreliance on executive management and a decentralized organizational structure could create issues for the company in the future.

I have presented three solutions that will help Berkshire Hathaway circumvent potential problems and increase efficiency within the organization. The company should undergo an initiative to define its organizational values to give Berkshire Hathaway a stronger corporate identity that is distinctly separate from Warren Buffett. It should also add a layer of divisional organizational structure to increase the vertical linkages in the organization. The company should also develop integrators to facilitate horizontal linkages between subsidiaries. These steps would improve the overall company, as well as the individual subsidiaries. Berkshire Hathaway has proven itself to be able to adapt to changes and challenges over the years, but it will have to continue to evolve to maintain the success that it has gained since Warren Buffett took the helm over four decades ago.

VI. Sources

Berkshire Hathaway. (2014a). Form 13F-HR 14-09-30. Retrieved from: http://www.sec.gov/Archives/edgar/data/1067983/000095012315002964/xslForm13F_X01/primary_doc.xml

Berkshire Hathaway. (2014b). Form 10-K 2014. Retrieved from: http://www.sec.gov/Archives/edgar/data/1067983/000119312515070966/d820461d10k.htm#toc820461_2

Berkshire Hathaway. (2015a). Letter to Shareholders. Retrieved from: http://berkshirehathaway.com/letters/2014ltr.pdf

Berkshire Hathaway. (2015b). Form DEF 14A. Retrieved from: http://www.sec.gov/Archives/edgar/data/1067983/000119312515091378/d854690ddef14a.htm

Bloomberg. (2015). Bloomberg Industry Market Leaders: Companies Grid. Retrieved from: http://www.bloomberg.com/visual-data/industries/grid/market-cap

Buffett, W. (1996). An Owner’s Manual. Retrieved from: http://www.berkshirehathaway.com/ownman.pdf

Cunningham, L. (2014). The Value of Corporate Culture: The Case of Berkshire Hathaway. Value Walk. Retrieved from http://www.valuewalk.com/2014/08/value-corporate-culture-case-berkshire-hathaway/

Daft, R. (2010). Organization theory and design (10th ed.). Mason, Ohio: South-Western Cengage Learning.

Hawk, M. (2015). Personal Communication. March 3, 2015.

Pearce, J., & David, F. (May 1987). Corporate Mission Statements: The Bottom Line. Academy of Management Executive, 109-115.

Sorkin, A. (May 5, 2014). Berkshire’s Radical Strategy: Trust. New York Times. Retrieved from: http://dealbook.nytimes.com/2014/05/05/berkshires-radical- strategy-trust/?_r=0

The Economist. (April 26, 2014). Life After Warren. Retrieved from: http://www.economist.com/news/leaders/21601255-all-his-success-building-great-corporation-warren-buffett-should-now-contemplate

VII. Appendix

VII. Link to PDF of Final Report